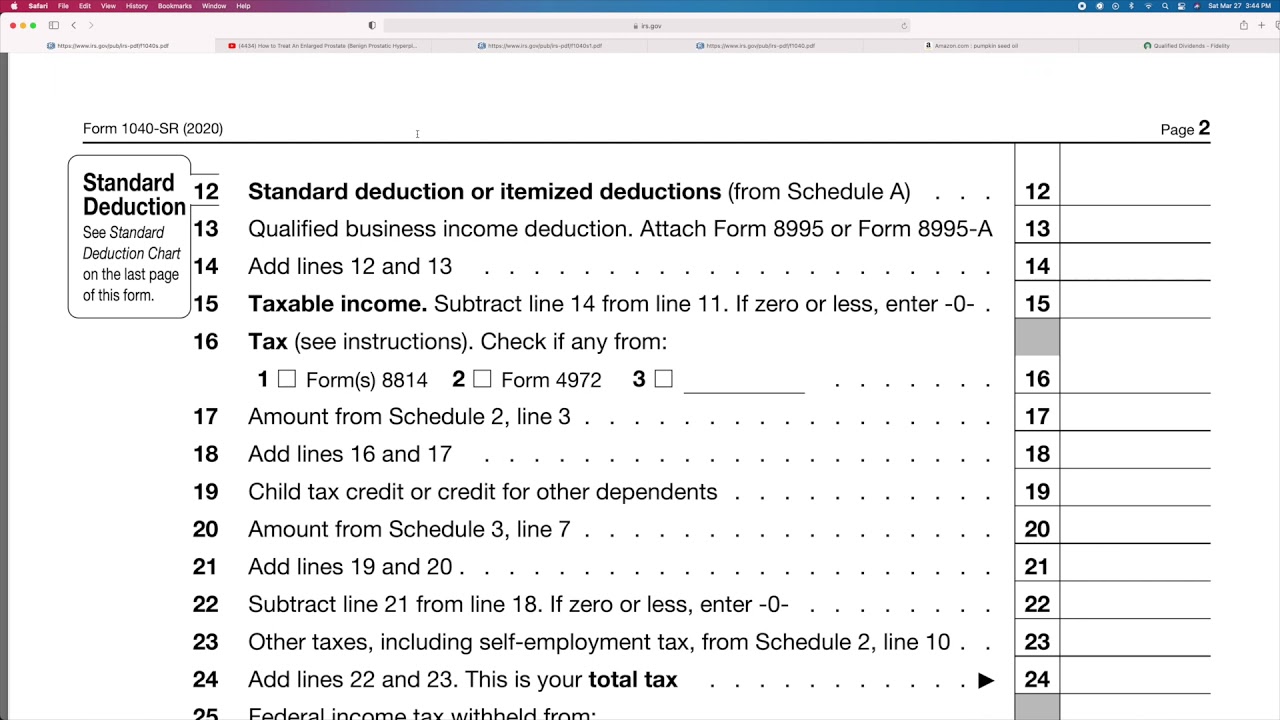

Standard deduction for seniors over 65. If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150.

Tax information for seniors and retirees, including typical sources of income in retirement and special tax rules. Taxpayers who are age 65 or older can claim an additional standard deduction, which is added to.

Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers.

In this article, we’ll look into what the standard deduction entails for individuals over 65 in 2025 and 2025, how it differs from standard deductions for.

2025 Standard Deduction Over 65 Tax Brackets Britta Valerie, The irs considers an individual to be 65 on the day before their 65th birthday. For individuals over 65 in 2025 (filing year 2025), the standard deduction is $21,150 for head of household, $27,300 for married couples filing jointly if only one.

2025 Standard Deduction Over 65 Tax Brackets Elvira Miquela, The standard deduction for those over age 65 in tax year 2025 (filing in 2025) is $15,700 for singles, $29,200 for married filing jointly if only one partner is over 65 (or. Section 194p of the income tax act, 1961 provides conditions.

Standard Tax Deduction 2025 For Seniors Online Birgit Steffane, Seniors over age 65 may claim an additional standard deduction of $1,950 for single filers and $1,550 for joint filers. 2025 standard deduction over 65.

Federal Tax Brackets For Seniors 2025 Lilli Paulina, The standard deduction for taxpayers over the age of 65 is higher than for younger taxpayers, acknowledging the unique financial challenges faced by this age group. Nc standard deduction 2025 for seniors over 65 kiley merlina, here are the amounts for 2025.

Standard Tax Deduction 2025 Over 65 Birgit Steffane, For the 2025 tax year, seniors over 65 may claim a standard deduction of $14,700 for single filers or $27,300 for married filing jointly if only one partner is over 65. The basic standard deduction in 2025 and 2025 are:

Irs Standard Deduction 2025 Over 65 Lonna Virginia, Section 194p of the income tax act, 1961 provides conditions. For seniors over the age of 65, the standard deduction is higher than it is for other.

1040 Sr Standard Deduction 2025 Erika Jacinta, $1,550 for married couples filing jointly,. The basic standard deduction in 2025 and 2025 are:

Standard Federal Tax Deduction For 2025 Cati Mattie, Section 194p of the income tax act, 1961 provides conditions. Nc standard deduction 2025 for seniors over 65 kiley merlina, here are the amounts for 2025.

Irs Standard Deduction 2025 Over 65 Lonna Virginia, Standard deduction 2025 over 65 seniors over age 65 may claim an additional standard deduction. This higher deduction helps to offset some of.

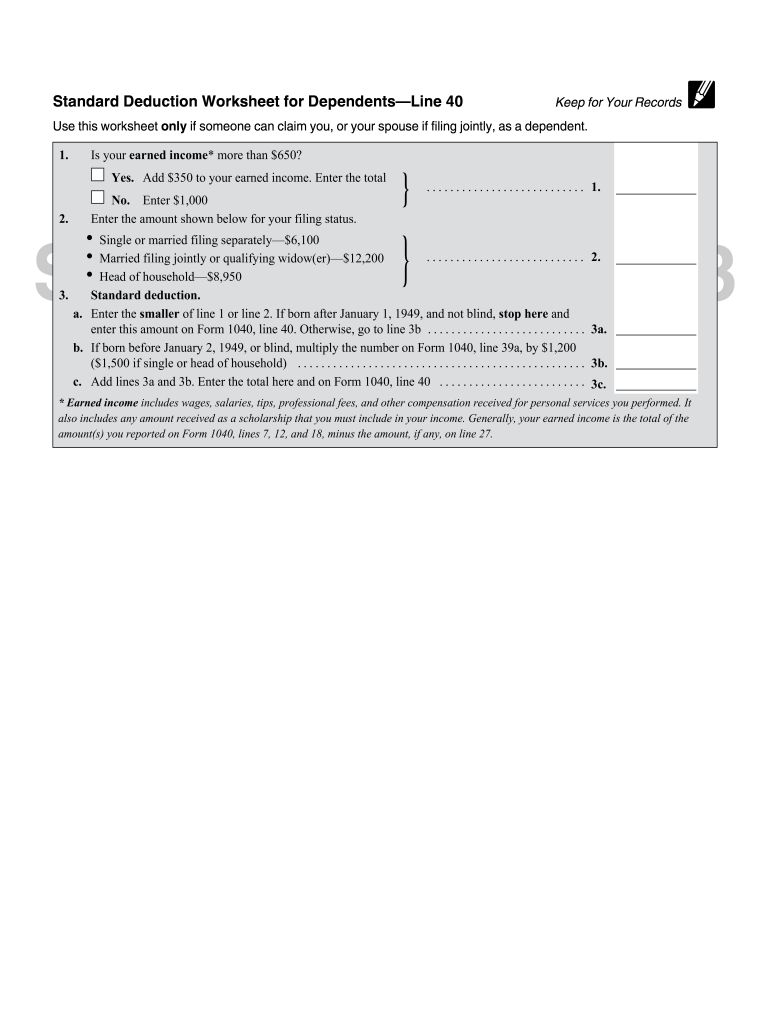

The Extra Standard Deduction for People Age 65 and Older Tips for, The standard deduction for seniors over 65 is $27,300 for married couples filing jointly and $14,700 for single filers. If you don't itemize deductions, you are entitled to a higher standard deduction if you are age 65 or older at the end of the year.

If you earned $75,000 in 2025 and file as a single taxpayer, taking the standard deduction of $13,850 will reduce your taxable income to $61,150.