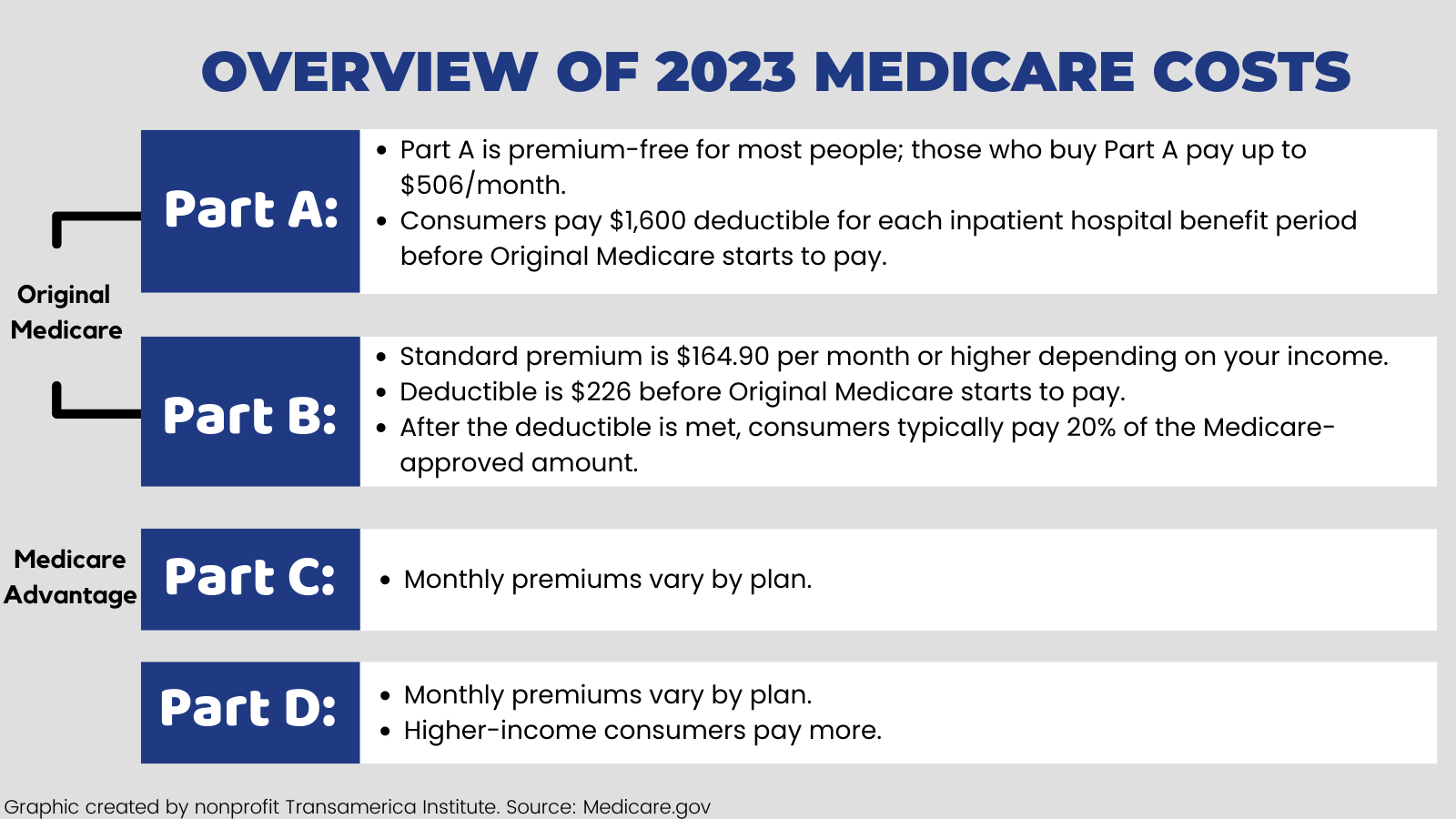

Max Medicare Tax 2025. Medicare part b is essential for medical coverage, and its standard monthly premium in 2025 is $185.00, a little over ten dollars more than the standard premium in 2025. Married with separate tax return:

Medicare premiums for 2025, and the cost of medicare part a deductible, medicare part b and part d premiums, have gone up. Irmaa is a tax on income through medicare.

What Is The Max Medicare Tax For 2025 Sybil Euphemia, The additional medicare tax of.9% applies to earned income of.

What Is The Max Medicare Tax For 2025 Sybil Euphemia, The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.

What Is The Max Medicare Tax For 2025 Sybil Euphemia, The maximum amount of earnings subject to social security tax is $176,100 for 2025.

Medicare Part D Premium 2025 Increase 2025 Megan Knox, The maximum fica tax imposed will be $10,918 ($176,100 x 6.2%), and there is no cap.

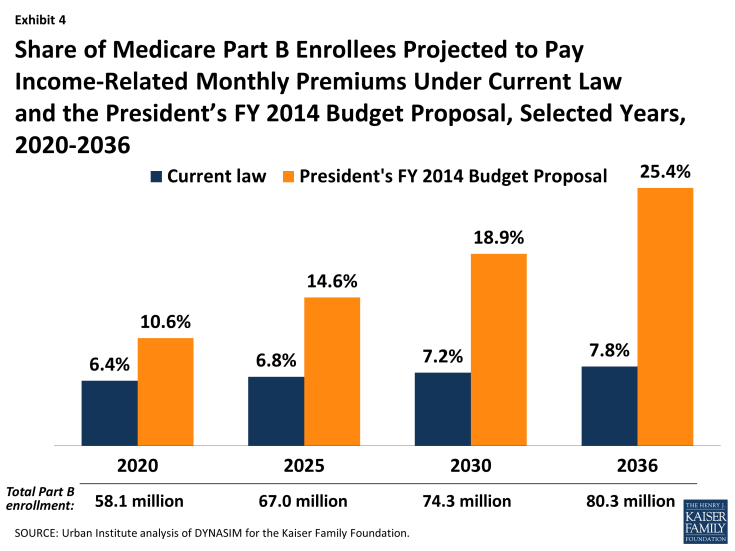

What Is The Max Medicare Tax For 2025 Kare Sandra, Irmaa is a fee that may be added to your medicare part b and part d premiums if your yearly income exceeds a certain amount.

Medicare Tax What is It and What Does It Do?, What is the medicare tax percentage for 2025 and how does it work?

What Is The Max Medicare Tax For 2025 Kare Sandra, 2.35% medicare tax (regular 1.45% medicare tax + 0.9% additional medicare tax) on all employee wages in excess.

The Additional Medicare Tax YouTube, The maximum amount of earnings subject to social security tax is $176,100 for 2025.

2025 Medicare Tax Rates And Limits Flori Jillane, The maximum amount of earnings subject to social security tax is $176,100 for 2025.

Changes to Medicare Part D in 2025 and 2025 Patient Empowerment Network, The medicare tax rate for 2025 remains at 1.45% of all covered earnings for employers and employees.